Cat Litter Products Market Size to Worth USD 19.25 Billion by 2032 | With a 3.95% CAGR (2026-2032)

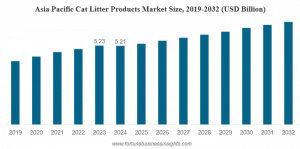

Asia Pacific dominated the cat litter products market with a market share of 37.16% in 2025.

Growing Adoption of Subscription-based Pet Products Services to Augment Market Growth”

PUNE , MAHARASHTRA, INDIA, February 8, 2026 /EINPresswire.com/ -- The global cat litter products market size demonstrates significant growth potential, valued at USD 14.02 billion in 2024. Industry projections indicate expansion to USD 14.67 billion in 2025, ultimately reaching USD 19.25 billion by 2032, representing a compound annual growth rate of 3.95% throughout the forecast period. Asia Pacific emerged as the dominant regional market in 2024, commanding a substantial 37.16% market share.— Fortune Business Insights

Key Market Drivers

The market's expansion is fundamentally driven by rising cat adoption rates worldwide. American households alone have seen remarkable growth, with approximately 49 million homes owning cats as of June 2025, compared to 40 million at the end of 2023. This dramatic increase in pet ownership directly correlates with heightened demand for litter products.

Consumer preferences increasingly favor sustainability and health-conscious pet products. Innovation efforts concentrate on addressing primary consumer concerns: odor control, dust reduction, and integration of smart features. These advancements respond to growing demand for convenience and sophisticated pet care solutions.

Get a Free Sample PDF- https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/cat-litter-market-106214

Market Segmentation Insights

Base Material Analysis: Clay-based products dominated the market with 49.64% share in 2024, attributed to their natural mineral structure, superior absorbency, strong clumping properties, widespread availability, and affordability. However, plant-based alternatives are experiencing the fastest growth trajectory at 5.58% CAGR, driven by consumer preference for sustainable materials and innovations utilizing corn, wheat, and recycled paper formulations.

End-User Distribution: The household segment maintains overwhelming market dominance with 96.16% revenue share in 2024, reflecting high domestic demand for convenient and hygienic litter solutions. The commercial segment, though smaller, exhibits the fastest growth rate at 4.48% CAGR, propelled by increasing adoption of automated cleaning functions and growing cat ownership within commercial facilities.

Price Range Dynamics: Mid-range products captured the largest market share at 44.14% in 2024, balancing affordability with enhanced features like odor control and improved cleanliness. Premium products are experiencing the fastest growth at 5.35% CAGR, fueled by demand for advanced technology-based litters incorporating biodegradable materials and activated carbon additives.

Distribution Channels: Supermarkets and hypermarkets led distribution channels with 35.39% market share in 2024, offering broader product assortment and competitive pricing. Online and e-commerce platforms demonstrate the highest growth potential at 5.96% CAGR, capitalizing on consumer preference for home delivery convenience and subscription services.

Regional Market Performance

Europe maintained market leadership in 2024 with USD 5.23 billion valuation and 37.19% global share. High cat ownership rates in the United Kingdom, Germany, France, and Italy, combined with urban living lifestyles, drive substantial product revenues. Germany alone accounted for USD 0.96 billion, characterized by premium brand preference emphasizing odor control and environmental sustainability.

North America holds the second-largest market position, driven by strong demand for premium litters featuring dust suppression and eco-friendly packaging. The United States market exhibits particular strength in premium clumping clay and silica formulas, supported by evolved distribution networks including specialty retailers, mass superstores, and rapidly expanding subscription models.

Asia Pacific represents the fastest-growing region at 5.64% CAGR, propelled by urbanization and increasing pet ownership across China, India, and Southeast Asia. Manufacturers actively invest in research and development to create innovative products, including flushable litter and advanced clumping formulations.

Market Opportunities and Challenges

Significant growth opportunities emerge from advancements in sensor-based litter products and smart technology integration. Products featuring automated waste disposal, real-time health monitoring, and app connectivity create new market segments. The 2025 introduction of Purina's Petivity Smart Litter Box Monitor exemplifies this trend, utilizing artificial intelligence and sensors to track cat health metrics.

Subscription-based services represent another expanding opportunity, offering convenient home delivery and scheduled product replacement. Premium, eco-friendly specialty litters delivered through subscription models appeal to evolving consumer preferences.

However, substantial research and development investment requirements present barriers to product development, involving significant capital expenditure for advanced machinery, technology development, and formulation innovation. Supply chain disruptions and raw material sourcing risks, particularly from trade restrictions, challenge international business expansion and production output maintenance.

Competitive Landscape

Leading market participants include Nestlé S.A., Church & Dwight Co., Inc., The Clorox Company, Mars Incorporated, and General Mills, Inc. These companies prioritize portfolio expansion, retail network broadening, and research and development investment to maintain market position.

Recent strategic developments include Oil Dri Corporation's USD 46 million acquisition of Ultra Pet in April 2024 to expand crystal litter offerings, and Clorox's commissioning of a new 97,000 square foot manufacturing facility in West Virginia. The Clorox Company's January 2024 investment in West Virginia plant expansion demonstrates commitment to scaling production capacity for Fresh Step and Scoop Away brands.

Innovation continues driving competitive advantage, exemplified by Petkit's June 2025 launch of sensor-enabled systems incorporating urination monitoring and facial recognition technology for multi-cat households, and Tidy Cats' April 2025 partnership with Whisker to develop specialized formulas for automated litter boxes.

Speak To Analyst- https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/cat-litter-market-106214

Future Outlook

The cat litter products market demonstrates robust growth potential driven by rising pet ownership, technological innovation, and evolving consumer preferences toward sustainable and convenient solutions. While traditional clay-based products maintain market leadership, plant-based alternatives and premium technology-integrated offerings represent the fastest-growing segments. Success in this market increasingly depends on balancing affordability with innovation, sustainability with performance, and traditional retail presence with digital distribution capabilities.

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.